Is Retirement an Outdated Concept?

Why put off your dreams until the last part of your life? Technology and new work models now offer people more flexibility to work longer and live retirement experiences along the way.

I am not sure if I will ever have a traditional retirement. There is unlikely to be a point in my life when I completely stop working and live my dreams.

However, I’m completely fine with that.

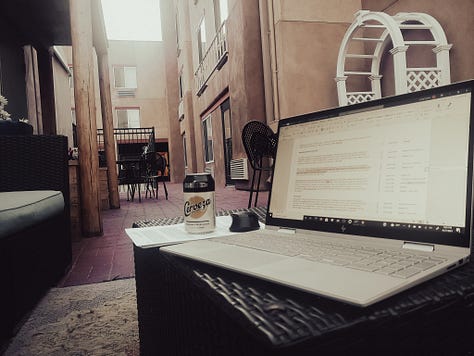

I’m remotely self-employed and can make a living from anywhere, working for whomever I want. I haven’t had to deal with bosses, corporate policies, or a commute in nearly twenty years. I set my own hours, take days off when I want, and generally reward myself with about eight weeks of vacation annually.

In some ways, I’m living my dreams now, and I’ve already probably had more “bucket list” experiences than most retirees will.

But the best part is that I love what I do. Writing, my profession, has never really seemed like “work” to me, and until I’m on my actual death bed, I don’t see any reason to completely quit.

Digital Self-Employment = Flexibility and Options

While I may never completely stop working, the nature and profitability of my writing will likely change as I age.

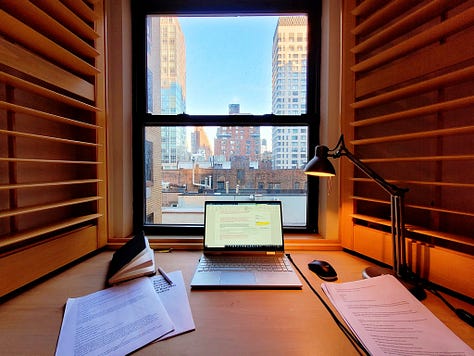

In a traditional 9-5 job, the only path to the promised land of retirement is to save enough money to sever ties from the workforce. However, things aren’t so black and white when you’re digitally self-employed. It’s a lot easier to scale back, adjust your workflow, or change the nature of your business to suit your evolving lifestyle.

Perhaps as I near my mid-60s, and assuming the financial equation works, I may take on some less profitable work I’m more passionate about. For instance, I write about banking, supply chain, and retail technology because they enable me to make a good living. However, my real passion is travel and adventure, which, unfortunately, doesn’t pay very well. Maybe as I age, I’ll be able to do more of that.

Maybe I’ll take fewer projects and find the right balance of work/time off I desire. Or, perhaps I’ll do more consulting work for which I can charge a higher hourly rate, thus making the same amount of money while working less.

I have many “retirement” options, but none of them involve a long-term goal of completely quitting work.

Some people may say I’m fortunate to be in this situation, but a growing number of people are finding new opportunities in self-employment. Connectivity and new technologies make it easier to work for anyone, anywhere, at any time, and (mostly) on your own terms. According to Bloomberg, approximately 15% of Americans are now self-employed. Some believe the actual number could be much greater when factoring in side gigs, part-time self-employment, and other independent sources of income.

Many people also work remotely and have flexible schedules and generous vacation time. While these people may not be self-employed, for many practical purposes, they have many of the same benefits and are positioned to scale into a flexible retirement model.

Retirement Isn’t the Goal. It’s the Backup Plan.

Rest assured that I save and invest for retirement, just like everyone else.

However, I have never viewed my “retirement” portfolio as an end game or a fund to quit working. I think of them more as insurance or a Plan B. Let’s say my business goes sideways in my 60s, I have major health issues as I age, or, for one reason or another, I just decide I want to call it quits. Then, I’ll resort to my backup plan: traditional retirement based on portfolio income and (hopefully) a little Social Security.

My problem with traditional retirement philosophy is that it views one’s “golden years” as the 60s to 80s, most notably when one stops working. In the 1950s and the days of factory work, this traditional model was the only option. However, technology and new work models have partly changed the picture and brought new possibilities.

Why put off so many experiences in the best and most physically healthy years of one’s life to the least healthy years? Why not strive to live the life one wants in the present and enjoy many retirement experiences along the way? Why not strive to maintain a consistent level of income and rewarding experiences throughout your 30s, 40s, 50s, 60s, and beyond?

While it’s risky not to save for your future, it’s also risky to put off your

life dreams until retirement.

There’s no guarantee that you will have the health, fitness, or endurance to do many of those things when you are 60, 65, or 70.

And there’s no guarantee you’ll even live to retire.

Time for a New Retirement Model?

The concept of a traditional retirement, where one stops working after a certain age, dates back to the 1800s. In the U.S., this idea gained more adoption during the Industrial Revolution when workers showed signs of aging and couldn’t maintain their productivity. Companies pushed retirement because these workers became a drag on the bottom line. Rather than experience the PR blowback of kicking them to the curb, they offered them pensions so they’d voluntarily leave and could be replaced with younger workers.

As time passed, workers began to view retirement as a magical promised land where they had no schedule and could live the life they always dreamed of. It also gave people incentives to bust their asses and be a corporate yes-sir for 30 years.

Views of retirement have started to change in the past couple of decades, especially since the advent of the digital era. People are also living a lot longer, leading them to work longer, retire later, and risk running out of money. In turn, this longevity increases the cost of retirement and postpones those promised “golden years” to even later in life.

In his book The 4-Hour Workweek, Tim Ferris says retirement is flawed for several reasons:

It is predicated on the assumption that you dislike what you are doing in the most physically capable years of your life.

Most people will never be able to retire and maintain more than a bare, basic living.

The few people who achieve a comfortable retirement already have the ambition to do something else or start a business.

The reality is half of Americans will never have enough money to retire. And of those who do retire, only a small portion will have the financial and physical abilities to do the things they imagined. Psychologists have noted that many people reach a bare minimum retirement only to lose a sense of identity and experience depression. Very few people will be able to do things in their 60s and 70s that they dreamed about in their 30s and 40s.

Over the past decade, a growing number of people have been questioning traditional retirement. NextAvenue notes that retired-age people are now working longer, using more technology, and paying more attention to their health. More are volunteering to stay in the workforce, albeit part-time or in a new career. BBC also notes that others are now scaling into a “flexible” or “semi-retirement” rather than a full one.

Another survey found that only half of people said they would stop working in retirement, while 70% said they would transition into a different type of work or work on their own terms if possible.

This may suggest people aren’t necessarily tired of working. They are tired of the demands and schedules of a traditional job and not being able to do what they want.

Replace Retirement with Lifestyle Design

I believe I can best hedge my financial and life dream risks by living experiences now and planning to work well past traditional retirement age.

Ferris notes people don’t necessarily want money or retirement; they want the things that money and retirement will enable them to have. The “New Rich” are less concerned about money and quitting work than they are about mobility, flexibility, and fulfilling the experiences they desire.

By using Lifestyle Design, more people are figuring out how to defer the traditional retirement path and attain those experiences along the way. This idea primarily hinges upon building income independence and flexibility earlier in life and then enjoying pieces of retirement along the way. Based on Ferris’ book, others’ ideas, and my own thoughts, I believe the new “retirement” goes something like this:

Find work you are truly passionate about.

Strive for remote/digital self-employment.

Consistently grow your income while reducing your hours.

Live “retirement” experiences throughout your life.

Certainly, this is easier said than done, and there’s no clear path to achieving this. However, to take advantage of the new retirement, people will have to stop playing by the old rules. When you invest 100% of your time, energy, and focus in working for someone and supporting their dream, there will be little time to work towards your own.

Start a small business. Get a side hustle. Whatever it is, experiment and find something. Some people may not be self-starters or cut out for self-employment. But at least try. Learn something new. Experiment. Pilot. Test. Explore options. Fail, learn from it, then fail again. Then, keep failing to find what works.

If all else fails, look to traditional retirement. But giving up all the best years of your life with the hope you’ll be able to do what you want at the very end shouldn’t be a goal.